COVID-19风险洞察 | 一位CRO的反思:我们能否更好地应对系统性风险?

发布于:2020-03-31 来源:GARP

本文作者:Brenda Boultwood

本文来源:GARP

经济体系往往在一个看似不稳定的系统中保持平衡。CRO经常会被问到他/她所在的组织在各种情况下会受到怎样的影响,包括正常的市场情况、尾部事件和复杂的事件。这些包含已知可能发生的事件(known unknowns),或未知的事件(unknown unknowns),以及一些不确定事件(uncertainty)。

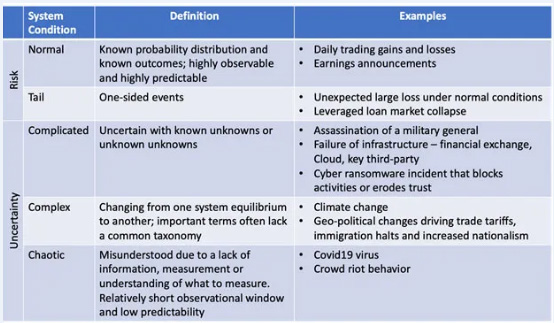

图1给出了此类事件的示例。

图1:系统条件

上述列表包含了比较完整的系统状态。风险管理人员对前三种情况最为熟悉,即正常(Normal)、尾部(Tail)和繁复状态(Complicated)。对这几种状态,我们已经建立了基于波动性的风险度量和压力测试,它们有助于解释和量化风险。

此外,针对这些状态下的非金融风险,我们也建立了较为成熟的对策。但是,针对后两种情况,即复杂状态(Complex)和混乱状态(Chaotic)下的风险管理方法则较少被考量。

极端的不确定性情况包括复杂性,即系统从一个平衡状态变化到一个新的状态,甚至是“混乱”状态。一个复杂状态的例子包括气候变化和地缘政治民族主义的变化。

混乱状态的定义是,启动条件未知的不可预测状态。例如,像COVID-19这样的流行病。

风险和不确定性不是同一件事

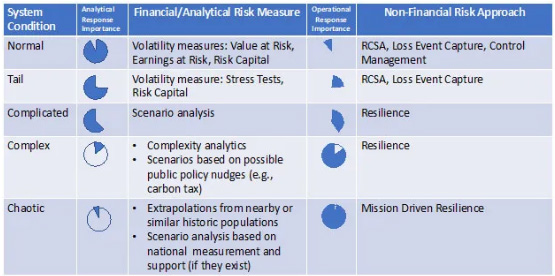

For the complex and chaotic events,standard risk measures do not apply.What's more,for these events,the importance of analytical risk measures diminishes compared to resilience planning.

For the normal and tail states,our day-to-day financial risk measures are models of a random process.We are comfortablewith the volatility tools that help us explain the impact and probability of anevent.

Any system that evolves over time will undergo chance,or random,fluctuations.A risk problem involves random fluctuations where the parameters and the functional forms required to determine the optimal decision are known.In an uncertain situation,at least one parameter,and perhaps all parameters,are unknown and must be estimated.

Figure 2 summarizes our approaches to financial and non-financial risk measurement,and the relative importance of each depending on the system condition.

Figure 2:Risk Measurement Approaches for Financial and Non-Financial Risks

混乱状态、复杂性分析和弹性

Systemic risk can be thought of as the risks of breakdown or major dysfunction in a system.After the financial crisis of 2008,we thought of systemic risk primarily from the inside out:for example,how an event at a single financial institution could impact aggregate systemic risk levels,or,more specifically,the potential impact of the financial institution on the financial markets.

When thinking about systemic risks,we also need to consider the“outside in”view–or how systemic risks impact the organization.For financial and non-financial institutions,what is the impact of macro-economic or external trigger events on the organization?That's the nature of the question posed to the CRO when the event is complex or chaotic.

Complex situations surround us,and risk managers should not feel bashful about borrowing analytic approaches from other fields such as weather forecasting,epidemiology and entropy estimates.Rather than basing a decision on a single analytic,a dashboard of complexity analytics can be useful to summarize potential short-and long-term impacts,and provide direction on the best organizational responses.

Every organization must,of course,address key issues during a global pandemic,including whether its employees are prone to be stricken and whether it's safe for employees to travel to the office to work.(Many firms,in the interest of health and safety,have already provided employees with the option to work from home in response to COVID-19.)

Analytical tools can help measure uncertainty via(1)estimating when a threshold is hit,and assessing the likelihood of a system change by visualizing tensions in system structure;(2)estimating epidemiological contagion rate;(3)estimating the proximity to a system change,such as a one-degree warming of an ocean;and(4)estimating the probability of a small system change–e.g.,an earthquake or wildfire.

I would argue that chaotic states will migrate to complex states when we gain consensus about the problem,its definition and how it is measured.As the observation window lengthens and measurement(even if in other countries)improves,the complexity measures discussed above will become useful.

But far more important than the analytical estimates of probability and impact of the complex or chaotic event is the resiliency approach taken by an organization.

The list of possible disruptions caused by a complex or chaotic event is long,and far beyond the thinking behind the typical business continuity management(BCM)plan.For example,a corporate lens on a COVID-19 global pandemic will extend the BCM plan to highlight additional factors and the supporting external infrastructure and supply chains,including:

Worker location and safety,and the health of their nearby family;

Hospital systems and their supply chains;

Access to food and water;

Work arrangements and supporting technology infrastructure;

Sources of complete and truthful information;

Transportation protocols;

Safety supplies;

Weather forecasts;and

Communication plans

Infrastructure companies,such as a financial exchange or a cloud provider,face reliability challenges,and may need to appeal to employees'commitment to the company mission.

进一步思考:如果再遇到这种情况应作何准备?

Very few of us know if we have this potentially deadly virus.We could choose self-quarantine,but there's clearlya lot of work to do to ensure our organization responds well.

For organizations existing in a chaotic system,leadership is more important than ever.The value of financial risk measurement in this kind of environment is limited;communication,planning and actions matter more to organizational survival.

All aspects of a firm's supply chain become critical.For the firms leading critical infrastructure,such as the cloud and financial exchanges,a mission driven employee appeal may be required to keep lights on.

Across the board,labor safety and supply will be critical.Ironically,those companies with remote work approaches and culture may fare the best assuming their remote work infrastructure(e.g.,Zoom meetings)continue to operate.

The CRO will be at the heart of an organization's resilience.He or she will require strong communication skills,an orientation to decisive action and an ability to translate opaque conditionsinto crisp steps that enhance organizational confidence.

相关阅读

COVID-19风险洞察|黑天鹅事件中的机遇:新型冠状病毒肺炎下中国银行业寻求稳定创新

作者Brenda Boultwood

Brenda Boultwood是一名独立的风险管理顾问。她曾担任美国联合能源公司的高级副总裁和首席风险官,并曾担任首席风险官委员会(CCRO)和GARP的董事会成员。此前,她曾担任MetricStream的行业解决方案高级副总裁,负责一系列关键行业的垂直领域的投资组合,包括能源和公用事业、联邦机构、战略银行和金融服务。在此之前,她曾在多家风险管理公司工作,并在摩根大通(JPMorgan Chase)担任另类投资服务(AlternativeInvestment Services)全球战略主管。在摩根大通,她为该公司的对冲基金服务、私人股本基金服务、杠杆贷款服务和全球衍生品服务制定了战略。

责任编辑:中国FRM考试网

Tags:

相关推荐