Why become a CFA?

发布于:2022-06-20 来源:未知

So You Want To Be A CFA…

Thinking about becoming a CFA?Here are some of the basics about how and why so many financial professionals pursue this coveted credential.

First,What Is A CFA?

CFA stands for Chartered Financial Analyst.It is a professional credential bestowed by the CFA®Institute on financial and investment professionals who have completed its program of study,passed all three levels of its examinations,and met other professional requirements.A successful candidate is awarded the“CFA charter”and becomes a“CFA charterholder”.Learn more about how to become a CFA.

Typically,it takes between two and five years to complete the CFA Program and pass all three levels of examination.

According to the CFA®Institute,there are more than 120,000 CFA charterholders worldwide.

Why Become A CFA Charter Holder?

1)Better Job Prospects–Financial services companies are taking longer to fill positions,choosing to focus on finding candidates who mesh with their cultures.In this competitive environment,CFA charterholders have a distinct advantage with demonstrated expertise in investment management and financial analysis.

2)Professional Credibility–As the Financial Times notes,a CFA is now the“gold standard”of Wall Street qualifications due to its rigor.It’s also a global designation,with charterholders in more than 145 countries worldwide,and carries weight with employers everywhere.

Who Should Take The CFA Exam?

The CFA examinations are very difficult.The CFA®Institute reporting pass rates below 50%for all three exams.However,a CFA charter is a prized addition to almost any financial professional’s work experience,including:

Finance Professionals.If you’re currently working in finance,the CFA charter can prove a big career-booster and help you advance in or attain job roles like research analyst,portfolio manager,financial strategist,investment banker and others.To complete the process,and get your charter,you will need to document 48 months of relevant work experience under your belt.

Other Professionals.Non-investment professionals such as attorneys or accountants also pursue the CFA charter.It’s a complementary qualification that broadens your professional expertise in preparation for leadership roles.Nearly 7%of CFA charterholders are C-level executives.

Students.You don’t have to be a working professional to enter the CFA Program.If you have the time and money,the CFA charter is a great addition to your resume/CV.It’s especially helpful if you’re certain on a career in finance.

Not an analyst?

Claritas Program

According the CFA“This self-study program can benefit anyone working in a financial services organization,from client services to compliance;from human resources to IT;from sales and marketing to legal services.

No prior experience or education is necessary(but you should be comfortable with English),and the program can be completed within six months.”

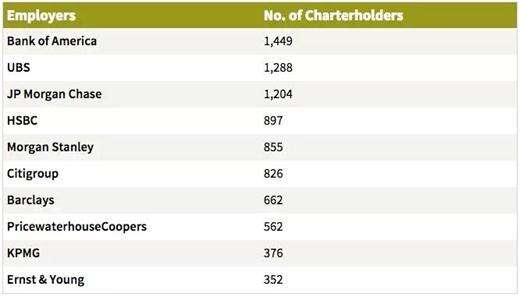

Who Are The Top CFA Employers?

Where might you land with the CFA charter?Based on July 2014 statistics,below are the Top 10 employers of CFA charterholders.

Which Is More Valuable,CFA or MBA?

This is an excellent question—and a hard one to answer,as both hold great value.

While the CFA charter often takes longer to earn than an MBA(2-5 years v.2-3 years,typically),there is a wide chasm in terms of cost.Completing the CFA Program costs under$10,000 when accounting for exam fees and CFA test prep materials,while an MBA can cost between$80,000 and$120,000,depending on the program.

However,you will likely retake one or more of the CFA exams.Less than 20%of candidates pass all three examinations on the first try.

The ROI?Well,it depends on your career ambitions.

The CFA Program is designed to provide charterholders with specialized skills like investment analysis,portfolio strategy and asset allocation.An MBA program is less specialized and suited for broader disciplines like marketing or general management.

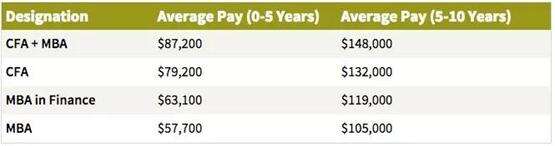

In terms of compensation,it pays better to hold a CFA charter but it pays even more to have an MBA as well.Below is a comparison from compensation research firm PayScale.

CFA Salary

In general,CFA charterholders earn roughly 25%more annually than MBA holders.

To fill a demand for finance and investment skills,many MBA programs—with the assistance of the CFA®Institute—are now incorporating large portions of the CFA Program into their curricula.

Learn more about the CFA Program at the the CFA®Institute.

责任编辑:中国FRM考试网

Tags:

相关推荐